Does Cash App Take Out A Percentage

Cash App is a mobile payment service developed by Square Inc allowing users to transfer money to one another using a mobile phone app. Squares Cash App has seen its active user base more than triple over the past two years to 24 million people and the payments platform recently rolled out to its clients the ability to buy and.

Cash App Revenue And Usage Statistics 2021 Business Of Apps

An extra app that lets you take bookings sync them to a calendar and process payments.

Does cash app take out a percentage. Squares processing fees are 265 per card present transaction 29 30 cents per paid Square Invoice and Square Online sale 34 15 cents per manually entered transaction and 010 for Interac chip PIN or tap sales. Cash App charges businesses that accept Cash App payments 275 per transaction. However Square updated its service to keep funds in your Cash account until you manually transfer them into your bank using the Cash Out button.

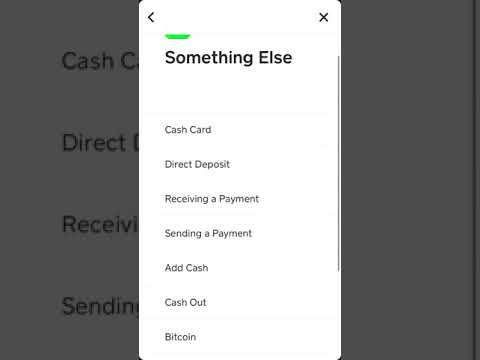

The Cash app currently gives us two options. Cash App is available in USA and the UK. See below for an explanation of each.

Paypal charges 025 to make an instant deposit. Confirm with your PIN or Touch ID. Cash out immediately which costs a one-percent fee or cash out in one to three business days which is free but takes longer.

60 per month per location. An individual makes an in-application peer-to-peer payment to a business. Paypal does charges a 29 fee plus 030 per transaction for payments made from a debit card credit card or PayPal Credit a line of credit Paypal offers.

Cash app fees can often be avoided by choosing the. To cash out funds from your Cash App to your bank account. The government fees you need to be aware of are SEC and TAC.

Cash App takes no fees from you but government fees apply to all the trades you make. Select a deposit speed. Cash Support Cash Out Speed Options Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card.

The other common charge Cash App users will see is a 15 commission added when they opt for instant transfers from the app to a bank account. In 2015 Square made Cash available for businesses in the United States. Instant Deposits are subject to a 15 fee with a minimum fee of.

These fees apply to all business types including non-profit organizations. Cash app charges the sender a 3 fee to send a payment using a credit card and 15 to make an instant deposit to a bank account. The service works with any email client and Apple and Android users can also download the Square Cash app to make the process of sending funds even easier.

When it comes to investing in stocks with Cash App there arent actually any fees that you need to pay for Cashing Out through the app. Adding or depositing money to your Cash App account can take from one to three days depending on your bank the site reports. Cash App charges a 3 percent fee if you use a credit card to send money but making payments with a debit card or bank account is free.

Right now users may borrow between 20 and 200 paying the loan back within 4 weeks at an interest rate of 5 percent. Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. This was the first step towards monetization as businesses were charged 15 percent per transaction while users can send money to friends for free.

Squares Payment Processing Fees. 50 per month for 2-5 users or 90 month for 6-10 users. The Cash Apps Loan feature is in beta with approximately 1000 users testing it out at first.

A special version of the app tailored for retail stores. These payments can be made in two ways. However this fee can.

Standard deposits are free and arrive within 1-3 business days. Cash App problems in the last 24 hours. Tap the Balance tab on your Cash App home screen.

Cash App also charges a 15 percent fee. You can also opt for Instant Deposits to your bank account which are immediate but come with a 15 percent fee according to a company representative. Cash Support Cash Out Instructions.

Users can send up. Choose an amount and press Cash Out.

Score Instant Cash Back With Cash App Boosts Creditcards Com

Tutorial Easy Guide On How To Card Cash App Complete Guide

Score Instant Cash Back With Cash App Boosts Creditcards Com

Cash App Borrow Cash App S Newest Loan Feature Gobankingrates

Tutorial Easy Guide On How To Card Cash App Complete Guide

How Much Does Cash App Charge To Cash Out A Guide To The Fees Almvest

Does Cash App Charge Clearance Fee And Automatic Deposit Fee

What Is Cash App Sugar Daddy Scam Youtube

How Much Does Cash App Charge To Cash Out A Guide To The Fees Almvest

Can You Send 5000 Through Cash App Find Quick Answer

Cash App For Business Account Use Fees Limits Explained

Cash App Carding Method 2021 Complete Tutorial For Beginners

How To Change Cash App From Business Account To Personal Account Youtube

Score Instant Cash Back With Cash App Boosts Creditcards Com

How Much Does Cash App Charge To Cash Out A Guide To The Fees Almvest

Posting Komentar untuk "Does Cash App Take Out A Percentage"